Imagine a credit card that goes beyond daily purchases and becomes your trusted ally in financial freedom. Some cards offer much more than just a spending limit, with exciting benefits that support your journey to financial independence – and the best part? Some don’t even require a deposit!

You will remain on the current site

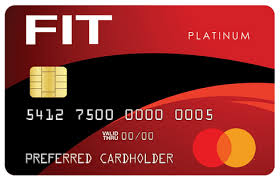

Think about this: what if you could start with a solid credit limit that could grow steadily with responsible use? This type of card seamlessly increases your purchasing power while helping you build a strong credit profile. It’s not just about having credit – it’s about making each purchase count toward a secure and brighter financial future.

But the perks don’t stop there. Imagine having your payment history reported to the major credit bureaus each month, reinforcing your dedicated financial reliability. Each on-time payment becomes another step in building a solid credit history, giving lenders and financial institutions more confidence in your creditworthiness. It’s like putting a spotlight on your financial discipline and achievements.

Additionally, some cards include perks like cashback rewards or travel points, allowing you to save or enjoy exclusive benefits while you spend. These incentives can make your credit card experience even more rewarding and practical for daily use.

And there’s more. This card offers free monthly access to your updated credit score, secure online shopping options, full digital account management, and robust fraud protection. It’s carefully designed to put financial control at your fingertips – ideal for those who want all the benefits of a credit card with the added bonus of building a resilient and secure financial future.

Ready to see how a credit card can do more for your financial goals? Head to the next page, where we break down all the essential details you need to get started on a path toward true financial freedom and success. Don’t miss this chance to learn more, gain valuable insights, and take the first step.

Great News! A Credit Card is Waiting for You

Great News! A Credit Card is Waiting for You